Software Free Product Tour AP Turnover vs. Some companies may spend more during peak seasons, and likewise may have higher influxes of cash at certain times of the year. Similarly, they might have higher ratios because suppliers demanded payment upon delivery of goods or services. Companies could have low turnover ratios due to favourable credit terms. While businesses may have strategic reasons for maintaining lower accounts payables turnover ratios than cash on hand would show is necessary, there are other variables.

Lower accounts payable turnover ratios could signal to investors and creditors that the business may not have performed as well during a given timeframe, based on comparable periods. Decreasing Accounts Payable Turnover Ratio While that might please those stakeholders, there is a counterargument that some businesses may be better off deploying that cash elsewhere, with an eye toward growth.

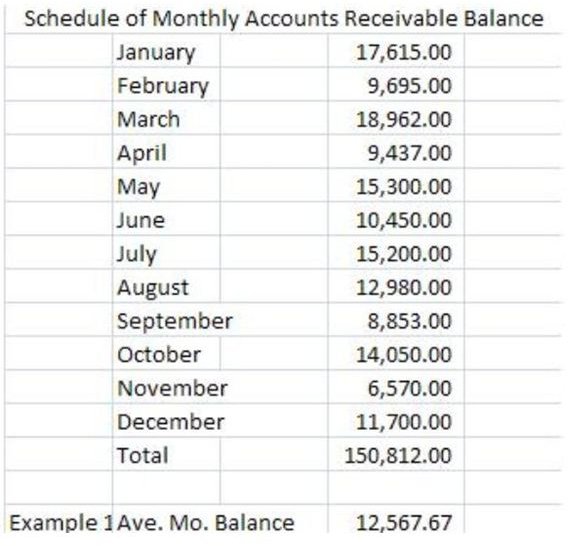

Higher figures indicate that a company pays its bills on a more timely basis, and thereby has less debt on the books. Increasing Accounts Payable Turnover RatioĬreditors and investors will look at the accounts payable turnover ratio on a company’s balance sheet to determine whether the business is in good standing with its creditors and suppliers. That means the company has paid its average accounts payable balance 6.25 times during that time period. Say that in a one-year time period, your company has made $25 million in purchases and finishes the year with an open accounts payable balance of $4 million. Accounts Payable (AR) Turnover Ratio Example But if the ratio is too high, some analysts might question whether your company is using its cash flow in the most strategic manner for business growth. If your business relies on maintaining a line of credit, lenders will provide more favourable terms with a higher ratio. Do you want a higher or lower accounts payable turnover? Generally, a high AP ratio indicates that you satisfy your accounts payable obligations more quickly. What is a good accounts payable turnover ratio? To see how attractive you will be to funders, match your AP ratio to peers in your industry. To see how your company is trending, compare your AP turnover ratio to previous accounting periods. Use this formula to convert AP payable turnover to days.Īccounts Payable Turnover Ratio in Days = 365 / Payable turnover ratio How can you analyse your accounts payable turnover ratio? Dividing that average number by 365 yields the accounts payable turnover ratio.Īverage number of days / 365 = Accounts Payable Turnover Ratio Breaking Accounts Payable Turnover into Days Accounts Payable (AP) Turnover Ratio Formula & CalculationĪccounts payable turnover rates are typically calculated by measuring the average number of days that an amount due to a creditor remains unpaid.

#Whats a good ar turnover ratio how to

How to Calculate Accounts Payable (AP) Turnover RatioĪccounting professionals calculate accounts payable turnover ratios by dividing a business’ total purchases by its average accounts payable balance during the same period. Businesses that rely on lines of credit typically benefit from a higher ratio because suppliers and lenders use this metric to gauge the risk they are taking.It could be using its cash strategically. Low AP ratios could signal that a company is struggling to pay its bills, but that is not always the case.A higher accounts payable ratio indicates that a company pays its bills in a shorter amount of time than those with a lower ratio.Key Takeaways on Accounts Payable (AP) Turnover Ratio On a company’s balance sheet, the accounts payable turnover ratio is a key indicator of its liquidity and how it is managing cash flow. Accounting professionals quantify the ratio by calculating the average number of times the company pays its AP balances during a specified time period. The accounts payable turnover ratio measures how quickly a business makes payments to creditors and suppliers that extend lines of credit. What is Accounts Payable (AP) Turnover Ratio? This is a critical metric to track because if a company’s accounts payable turnover ratio declines from one accounting period to another, it could signal trouble and result in lower lines of credit.Ĭonversely, funders and creditors seeing a steady or rising AP ratio may increase the company’s line of credit. A high accounts payable ratio signals that a company is paying its creditors and suppliers quickly, while a low ratio suggests the business is slower in paying its bills.

0 kommentar(er)

0 kommentar(er)